To navigate long-term care insurance claims, start by thoroughly understanding your policy’s coverage, exclusions, and limits. Gather detailed documentation like medical records and bills, and stay organized throughout the process. Communicate clearly with your insurer, respond quickly to requests, and track your submissions. If issues arise, review denial reasons carefully and consider appeals. Staying proactive and informed can help you access benefits smoothly—continue exploring these strategies to manage your claims effectively.

Key Takeaways

- Review policy exclusions, coverage limits, and eligibility requirements to understand what is and isn’t covered.

- Gather comprehensive documentation, including medical records, bills, and care plans, to support your claim.

- Follow insurer submission procedures carefully and track your claims regularly for timely processing.

- Respond promptly to any requests for additional information or clarification from the insurance company.

- If denied, analyze the reasons, gather supporting documents, and consider escalation or appeals to recover benefits.

Understanding Your Policy and Coverage Details

To make the most of your long-term-care insurance, comprehending your policy and coverage details is vital. You need to understand policy exclusions, which specify what isn’t covered, so you’re not caught off guard during a claim. Review these exclusions carefully, as they can impact your benefits. Additionally, be aware of potential premium adjustments; your premiums might increase over time due to policy changes or inflation protections. Knowing these details helps you plan financially and avoid surprises. Familiarize yourself with coverage limits, waiting periods, and eligibility criteria. Be mindful that juice cleansing and detox strategies are unrelated to insurance policies but can influence overall wellness, which may be relevant for long-term care planning. By understanding your policy thoroughly, you’ll be better prepared to navigate claims smoothly and ensure you receive the benefits you’re entitled to when needed.

Gathering Necessary Documentation and Evidence

To guarantee your claim moves smoothly, you need to gather the right documents and evidence. Make a checklist of what’s required, including medical records, billing statements, and care plans. Having everything organized and ready will help support your claim and speed up the process. Additionally, understanding the horsepower of electric bikes can help you better explain your needs when discussing your care requirements with providers.

Required Documentation Checklist

Gathering the right documentation is essential to make certain your long-term-care insurance claim proceeds smoothly. You’ll need key items to support your benefits overview and justify your claim. Keep copies of medical records, physician’s reports, and care plans. Also, gather proof of expenses, such as bills and receipts, to support your claim’s validity. Here’s a helpful checklist:

| Document Type | Purpose | Notes |

|---|---|---|

| Medical Records | Verify health status | Ensure completeness |

| Physician’s Statement | Confirm care needs | Update regularly |

| Expense Receipts | Support claim amounts | Keep organized |

| Policy Documents | Reference benefits and coverage | Review for benefits overview |

Having these documents ready can impact premium considerations and streamline approval. Additionally, maintaining accurate documentation can help identify patterns and support ongoing claims.

Evidence to Support Claims

Having the right evidence is essential for ensuring your long-term-care insurance claim is approved smoothly. You’ll need to gather specific documentation that clearly shows your need for care. Imagine providing:

- Medical assessments from your healthcare provider that detail your condition and functional limitations.

- Records of treatments, medications, and ongoing care needs.

- Documentation showing how your condition aligns with policy exclusions, ensuring you’re eligible for benefits.

- Detailed product features that demonstrate the coverage specifics relevant to your situation.

Be thorough in collecting this evidence, as insurers closely review medical assessments and check for any policy exclusions that might affect your claim. Missing or incomplete documentation can delay approval or cause denials. Make sure all your paperwork is accurate, up-to-date, and thorough to support your case effectively.

Communicating Effectively With Your Insurance Provider

Effective communication with your insurance provider is key to a smooth claims process. You should use clear documentation, understand your policy language, and respond promptly to any inquiries. These strategies help make sure your claims are handled efficiently and accurately. Additionally, being aware of potential risks in merchant services can help you identify and address any issues that may arise during the claims process.

Clear Documentation Practices

Clear communication with your insurance provider is essential to guarantee your long-term care claims are handled smoothly. Proper documentation ensures you avoid common pitfalls like policy exclusions or missed claim deadlines. To stay organized, consider these practices:

- Keep detailed records of care expenses, dates, and provider information.

- Review your policy carefully to understand exclusions and coverage limits.

- Submit all required forms promptly, paying close attention to claim deadlines.

- Understanding the claims process can help you anticipate and address potential issues early.

Understanding Policy Language

Understanding the language in your insurance policy is crucial for effective communication with your provider. Policies often contain specific terms, including policy exclusions, which clarify what isn’t covered. Recognizing these exclusions helps you avoid misunderstandings when submitting claims or asking questions. Additionally, knowing how premium adjustments work ensures you stay aware of potential costs or changes to your coverage over time. Some policies may increase premiums if certain conditions are met, so understanding the language around premium adjustments allows you to plan accordingly. Take the time to carefully review your policy documents, highlighting key sections related to exclusions and premium changes. Clear understanding empowers you to communicate confidently and avoid surprises, ensuring smoother interactions with your insurance provider. Being familiar with market research can also help you better understand how your premiums are determined and how to navigate potential changes effectively.

Prompt Communication Strategies

When communicating with your insurance provider about long-term care claims, promptness can make a significant difference in the outcome. Quick responses help prevent claim escalation and streamline dispute resolution. To stay ahead, consider these strategies:

- Keep detailed records of all conversations, dates, and correspondence.

- Respond promptly to requests for additional information or documentation.

- Follow up regularly to ensure your claim isn’t delayed or overlooked.

- Be aware of support hours and plan your inquiries accordingly to ensure timely assistance.

Being proactive keeps your case moving forward and minimizes misunderstandings. If issues arise, addressing them swiftly can prevent conflicts from escalating. Clear communication demonstrates your seriousness and can help resolve disputes efficiently. Remember, timely engagement with your provider is your best tool in navigating the complexities of long-term care claims.

Navigating the Claims Submission Process

Handling the claims submission process for long-term care insurance can seem complex, but breaking it down into clear steps makes it manageable. First, review your policy carefully to understand any exclusions that might affect your claim. Some policies exclude certain conditions or types of care, so knowing these upfront helps you avoid surprises. Next, pay attention to claim timing; submitting your claim promptly after care begins ensures you meet deadlines and reduces delays. Prepare all necessary documentation, such as medical records and provider details, to support your claim. Follow your insurer’s specific submission procedures, whether online or by mail. Staying organized and informed about policy specifics helps streamline the process and increases your chances of a smooth, successful claim. Additionally, understanding how cheating can impact emotional well-being might influence your approach to managing stress during claims processes.

Addressing Common Challenges and Delays

Despite your best efforts, common challenges and delays can still arise during the claims process. You might encounter issues like policy exclusions that limit coverage, unexpected delays in claim timelines, or incomplete documentation causing hold-ups. Visualize these hurdles as a maze you must navigate:

- A fence of policy exclusions blocking coverage options.

- A ticking clock representing extended claim timelines.

- Piles of paperwork slowing down the review process.

- Limited understanding of insurance policy terms can hinder your ability to address issues promptly.

To address these challenges, stay proactive by thoroughly understanding your policy’s exclusions and coverage limits. Keep detailed records and follow up regularly to prevent delays. Recognizing these obstacles early helps you manage expectations and keeps your claims moving forward efficiently.

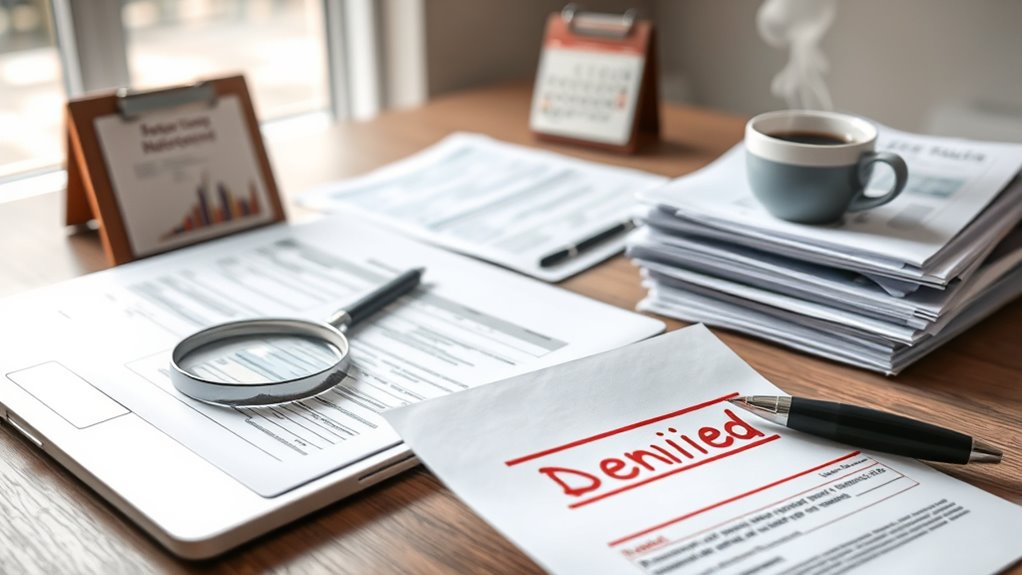

Reviewing and Appealing Denied Claims

If your long-term care insurance claim is denied, taking prompt action to review and appeal the decision can help you recover the benefits you’re entitled to. Start by carefully examining the denial letter, paying close attention to policy exclusions that could have led to the rejection. Gather supporting documentation, such as medical records and provider statements, to strengthen your case. If initial appeal efforts fail, consider claim escalation by contacting higher-level claims reviewers or your insurer’s ombudsman. Use the table below to understand common reasons for denial and steps to counter them:

| Reason for Denial | How to Address It |

|---|---|

| Policy exclusions | Review policy details, provide necessary proof |

| Incomplete documentation | Submit extensive, accurate records |

| Medical necessity issues | Obtain detailed provider statements |

| Claim escalation needed | Request higher-level review or appeal |

Tips for Ensuring Ongoing Claim Support

To guarantee your long-term care insurance claims continue smoothly, it’s essential to maintain ongoing communication with your provider and promptly update them with any changes in your condition or circumstances. Regularly review your policy for exclusions that could affect coverage, so you’re aware of any limitations. Keep your beneficiary information current—mistakes or outdated details can delay support when it’s needed most.

Here are three tips to ensure ongoing claim support:

- Schedule periodic check-ins with your insurer to clarify policy exclusions and coverage details.

- Notify your provider immediately of health updates or changes in care needs.

- Update your beneficiary information promptly after any life changes to prevent claim disruptions.

Staying proactive helps avoid surprises and keeps your claim process on track.

Frequently Asked Questions

How Long Does the Entire Claims Process Typically Take?

The claim timeline varies depending on your insurer and case specifics, but generally, the processing duration takes about 30 to 90 days. You might experience delays if your paperwork is incomplete or additional documentation is needed. To speed things up, stay proactive by providing all requested information promptly. Remember, staying in regular contact with your claims representative can help make sure your long-term care insurance claim moves smoothly through the process.

What Are Common Reasons for Claim Denials?

You might worry about claim denial reasons, but understanding common pitfalls helps. Claim denial reasons often include insufficient documentation requirements, missing paperwork, or failure to meet policy criteria. To avoid this, make sure all documentation requirements are thoroughly completed and submitted promptly. Staying organized and double-checking your paperwork can greatly reduce the chances of denial, so you get the benefits you need without unnecessary delays.

Can I Switch Insurance Providers During a Claim?

You might wonder if you can do a policy transfer or switch providers during a claim. Generally, switching insurance providers during an active claim isn’t straightforward and can complicate your coverage. Some policies allow a provider switch, but it often requires approval and may impact your claim process. Always review your current policy’s terms and consult your insurer before making a provider switch to avoid disruptions.

How Can I Prevent Claim Delays in the Future?

Think of your claim process as a well-oiled machine. To prevent delays, keep your policy documentation and claim documentation in pristine condition, like a carefully curated library. Always review your paperwork for accuracy and completeness before submitting. Stay proactive by communicating promptly with your insurer and updating any changes. This way, you’ll keep the gears turning smoothly and avoid unexpected hiccups down the road.

What Legal Rights Do I Have if My Claim Is Unfairly Denied?

If your claim is unfairly denied, you have legal recourse to challenge the decision. You can file claim appeals, providing additional documentation or clarification. You also have the right to review your policy and seek assistance from an attorney or advocate specializing in insurance claims. Understanding your rights empowers you to take necessary steps to overturn unfair denials and guarantee you receive the benefits you’re entitled to.

Conclusion

Steering long-term care insurance claims is like steering a ship through unpredictable waters. With the right knowledge and preparation, you can chart a steady course, avoiding storms of confusion and delays. Stay proactive, communicate clearly, and review every detail carefully. When challenges arise, don’t be afraid to adjust your sails and seek support. With perseverance, you’ll reach calmer waters, ensuring your care needs are met without unnecessary turbulence.